Effortless 1099s, Ongoing Bookkeeping—Capgro Has You Covered

At Capgro Bookkeeping Services LLC, we specialize in 1099 preparation and monthly bookkeeping services designed for busy small business owners and independent contractors. Whether you need remote 1099 filing for small businesses or ongoing support, our team of QuickBooks 1099 experts ensures compliance and clarity. Looking for affordable 1099 and bookkeeping services online? We make it simple, accurate, and stress-free. We help you meet IRS deadlines and keep your financials organized—so you can focus on running your business.

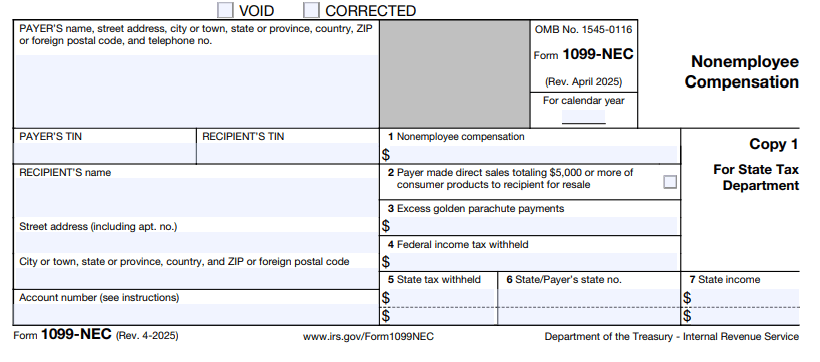

When 1099 NEC and 1099 MISC Are Required

Understanding which 1099 form to file can be confusing—but getting it wrong can be costly. Here’s what you need to know:

1099-MISC: Used for other types of payments like rent, prizes, or legal settlements.

Both forms must be filed with the IRS and provided to your payees on time.

Whether you need remote 1099 filing for small businesses or ongoing monthly bookkeeping services, we’ve got you covered.

What We Do Next — Our Filing Methods

Why Capgro Bookkeeping Services?

✅ Over 10 Years of Accounting Expertise

✅ 💻 100% Remote & Secure Services

✅ 🧾 Certified QuickBooks 1099 Experts

✅ 📈 Scalable Bookkeeping Plans After Tax Season

✅ ⏱ Fast Turnaround for 1099 Filing

✅ 💬 Friendly, Transparent Communication

Capgro is your trusted partner for both 1099 preparation and ongoing monthly bookkeeping services—from setup to submission.

How It Works

Step 1: Book a Free 15-Minute Consultation

Step 2: Upload Your Contractor Payment Info

Step 3: We Prepare & File Your 1099s

Step 4: Add Ongoing Monthly Bookkeeping Support (Optional)

Step 5: Rest Easy—We’ve Got You Covered All Year

Whether you need QuickBooks 1099 experts near me or affordable 1099 and bookkeeping services online, our process is simple and efficient.